The wraiths of climate change — floods, winds and fires — have finally hit a major pain nerve in our economic system.

The reaction is likely to trigger the kind of substantial reform that climate activists have been after for years. While protests have succeeded in spotlighting the environmental cause, this threat to corporate profits has finally penetrated the system.

This week protests went up a notch as tens of thousands of supporters of climate action filled the streets of New York City. The action was copied around the world. Their fury was heightened by revelations that EXXON had undermined organizations like the United Nations Intergovernmental Panel on Climate Change and cast doubt on its findings linking fossil fuels to climate change.

Now, however, there is a big threat to the EXXONs of this world: the climate cudgel is being taken up by a corporate sector of major significance — the insurance industry.

Profits in the insurance sector are threatened by huge losses due to climate change, and companies are hurriedly revising their coverage offerings for besieged areas. In some cases, no coverage will be available at all, leaving major centres high-and-dry for future investment and causing a stampede to less threatened zones.

They recognize that further changes in the global climate are already baked into the ecosystem for at least the next ten years, so their concerns have expanded beyond individual catastrophic events to focus on the longer interactions between the global climate and human systems.

A new BlackRock study shows that insurers representing US$27 trillion (yes, Trillion dollars) in assets are prioritising sustainable investing.

Blackrock is the world’s largest risk assessment company, whose 19,000 employees directly manage US$9.42 trillion in assets. When it comments, global capitalism listens.

And what Blackrock said about climate change was shocking to companies that had not kept up with the news.

Its study found that 95% of global insurers believe that climate risk is an investment risk.

The study noted: “The findings come following an unprecedented year of natural disasters, reflecting the perspective of an industry that is directly exposed to physical risks presented by climate change.”

Charles Hatami, Global Head of the Financial Institutions Group and Financial Markets Advisory at BlackRock said: “An overwhelming majority of insurers view climate risk as investment risk, and are positioning portfolios to mitigate the risks and capitalize on the transformational opportunities presented by the transition to a net-zero economy. Insurers’ growing focus on sustainability should be a clarion call for the investment industry.”

The tectonic shift towards sustainable investing involves reallocating existing assets to sustainable risk-adjusted performance.

Insurers now embed sustainability into their investment processes and strategies. Nearly half of respondents confirmed they have turned down an investment opportunity over the past 12 months due to Environmental, Social and Governance (ESG) concerns.

The bottom line from Blackrock: environmental risk is now considered a serious threat to a firm’s investment strategy, with more than one in three respondents citing it as a potential headwind.

Climate change has thus destabilized the insurance industry, driving up prices and pushing insurers out of high-risk markets.

This will have a devastating effect on real estate values, as homes that were once insurable will now be completely at risk.

The president of one of the world’s largest insurance brokers, Aon PLC’s Eric Andersen, said “Just as the U.S. economy was overexposed to mortgage risk in 2008, the economy today is over-exposed to climate risk.”

Natural disasters are destroying homes and businesses at record-breaking rates and putting entire food systems at risk, says consulting firm McKinsey and Company. Business models must adapt to the immediacy of climate change effects.

Most big insurers have pulled storm coverage insurance out of Florida already. Homeowners are scrambling to find smaller private companies that are already straining to stay in business.

In California State Farm, which insures more homeowners in the state than any other company, said it would stop accepting applications for most types of new insurance policies in the state because of “rapidly growing catastrophe exposure.” In this category it includes wildfires as well as storms.

A spokesman for the California Department of Insurance said the agency was working to address the underlying factors behind the disruptions in the insurance industry across the country and around the world, including the biggest one: climate change.

In Louisiana some communities are facing insurance costs that threaten their existence. Insurers began leaving following Hurricane Katrina in 2005. Then, starting with Hurricane Laura in 2020, a series of storms pummeled the state. Nine insurance companies failed; people began rushing into the state’s own version of Florida’s Citizens plan.

In the past, it might have been possible for some communities to go without insurance altogether. But as climate change makes storms more intense, that’s no longer an option.

JobOneForHumanity’s contributor Dan Hardy warns policy holders: “If you don’t see your policy canceled immediately or your rates soar by a multiple, so there’s no way you can afford them, and you’re in a medium to high-risk area; there is another strategy that insurance companies worldwide are implementing. They will be adding clauses to existing policies and new terms that state in one form or another, “all known or predicted climate change-related damages will not be covered by this policy.” They will probably list many of the climate consequences in these new policies, or they may include the new no climate coverage clauses in small print.

JobOne’s Executive Director Lawrence Wollersheim offers some solace to people needing climate change help: “You can do many things to “harden” your current location and build climate change resilience no matter where it is located. At Job One For Humanity website, we describe dozens of effective climate resilience-building actions.

“We also candidly discuss the limitations of specific locations over time as climate change conditions worsen; a checklist is available. Even for the worst-case situations that will develop over time, we discuss many adaptive strategies, such as relocation or managed retreat.”

JobOne has launched a project to build network of sustainable, climate change, and disaster-resilient urban and rural eco-communities called ClimateSafe Villages…more to come in a later article.

This kind of guidance is getting critical as insurance companies increasingly pull out of offering coverage to property that is threatened by “climate change” events.

The plus side of that, is what it means: an entire sector of the financial community has concretely acknowledged the reality — and the threat — of climate change.

Previously, some critics had said that action on climate change needed to wait for clearer proof about the causes. The trouble with that is that by the time we get the proof, it may be too late to take action.

This is where the insurance sector makes a huge difference: they already know that decisions to move away from fossil fuel companies could save them tens of billions of dollars. A hard cold look at the facts of insurance coverage reveals an ugly investment picture: in 30 years of onshore and offshore large risk losses for the insurance industry insurers sustained roughly $60 billion in losses from fossil fuel companies.

Florida is a petri-dish example of the growth of the insurance germ. Florida is the ideal test-case for climate-related disputes because between 1851 and 2018, 41% of the 292 hurricanes that hit the U.S. also hit Florida — and 37 of those 120 hurricanes were rated a Category 3 or higher.

Farmers Insurance is just the latest in an exodus of more than a dozen other Florida insurance companies that have stopped writing home insurance policies in the state.

Florida’s financial services CFO Jimmy Patronis protested that these companies “Don’t get to leave after taking policyholder money.” He threatened that they would be prevented from offering auto insurance if they were not doing homeowners insurance as well.

How this plays out is of little consolation to those without home insurance. Even those with current policies are paying a premium for being in a climate danger-zone: Floridians pay over $4,200 for their yearly home insurance premium — an increase of 42% over last year, and a huge jump over the US national average of $1,700.

“In Orlando if a house predates 2010 and is worth less than $300,000, no company is going to write [insurance for] you,” warns Locke Burt, CEO of Security First Insurance Co.

So the insurance companies are unlikely to be persuaded by the state of Florida. After a series of major storms Florida’s insurers saw a profit of almost $800 million in 2014 dwindle to a net loss of $340 million in 2019, and it has carried on in that manner ever since.

The legal litigation triggered by climate change cases is one reason for the loss. $51 billion was paid out by Florida insurers over 10 years and some 71% of that total went to attorney’s fees and public adjusters while only 8% went to claimants.

The bad news carries along the Gulf Coast. A recently published study from the Pacific Northwest National Laboratory that looked at how climate change was strengthening hurricanes along the East and Gulf Coast found that hurricanes impacting the U.S. could rise by one-third if things don’t change.

There was a methane gas explosion in Freeport, Texas, recently, for example, that damaged America’s second-largest plant. AIG and Liberty Mutual were among the companies that issued insurance policies. The nonprofit consumer advocacy group Public Citizen stated that “Fossil fuel companies cannot operate without insurance, which means insurers are critical gatekeepers of climate chaos.”

Lloyd’s of London has just announced plans to stop selling insurance for some types of fossil fuel companies by 2030. In the slow-moving world of insurance, this is a huge deal: the institution not only took a clear stand in the industry’s debate on climate change, it also cast doubt on the value of the business it intends to give up.

Other European companies significantly restricted their coverage of new oil and gas projects, including British insurer Aviva, French insurer AXA, German Allianz, and Swiss reinsurer Swiss Re.

But not a single U.S. insurer has ruled out support for oil and gas expansion projects. Yet.

Data analytics firm Verisk has confirmed that over the past few years a distinct pressure from investors has arisen around Environmental, Social and Governance (ESG) issues. They are concerned about the coverage insurers and reinsurers should be willing to offer.

Up until now, insurance companies have been able to pass along the cost of environmentally created damages to consumers. That is changing.

In May, State Farm stopped insuring new California homeowners because of “rapidly growing catastrophe exposure.”

AIG is one of the only insurers in the U.S. to stop insuring or investing in new coal projects. The company also publicly acknowledges that “climate change poses a major and unprecedented threat to human health.” That concern for climate is driven by profit losses — AIG lost around $450 million due to Hurricane Ian last year. Its profits from insuring the fossil fuel projects profits weren’t enough to offset their losses. As the Substack HEATED notes: “last year, AIG stopped covering new California homeowners because of wildfire costs. This spring, AIG limited homeowners insurance in 200 disaster-prone zip codes, including in New York and Florida.”

Allstate also decided to drop climate damage coverage for new homeowners in California. Allstate said the rising costs of wildfires were too much for their bottom line.

Overall in the U.S., unpriced flood risk from residential properties amounts to an overvaluation of some US$121–US$237 billion. i.e. many properties are not formally recognized as being located in climate-threatened zones, but in fact are exposed to weather disasters.

An aftershock of the insurance cancellations is that they create a housing demand surge in climate-safer areas. It’s like passengers running across the deck of a tilting boat to escape the insurance burden, only to find that their combined weight is now upsetting the higher deck as well.

House values will drop on the sinking side of the boat, and will be unaffordable on the rising side. The deck’s angle will get steeper. Panic could set in. And we could have a real estate market collapse.

This is being brought on by three irresponsible actions of market players who only need to consider their own portion of the economic pie:

· Private-sector companies which cause climate change and which do not hold themselves responsible for the downstream effects of their profit-seeking;

· Private sector insurers which bail out of climate-threatened areas; and

· Private sector property buyers who act independently to improve their own position, at the expense of the social good.

In the meantime, other financial institutions have not been forced to catch up with the insurance industry’s realization. The financial services industry spent $3.7-billion last year lending to oil and gas companies.

The picture they see is that energy demand is linked to population growth. Our population is projected to hit 10bn in the early 50’s, which means our energy demand is going to DOUBLE what it is now.

I personally think that their calculations are dead wrong in extrapolating that demand to a requirement for fossil fuels. That is the kind of thinking that put the car sector so far behind where it needs to be; it extrapolated a slow straight-line market increase for EVs.

Instead, EVs took off like a rocket and the projection is that they will make up the majority of vehicles on the road within a decade. They are much more efficient, they are cheaper and easier to produce, and their carrying cost for operation and fuel is much lower.

Stanford University futurist Tony Seba, who forecast that fossil fuels and nuclear energy would both be obsolete by 2030: “the combination of solar, wind, and batteries (SWB) is both physically possible and economically affordable across the entire continental United States as well as the overwhelming majority of other populated regions of the world by 2030.”

Thinking like this is what is pushing Ford to make the single largest investment in its 118-year history, in EV auto plants.

By contrast, the kind of straight-line extrapolation that the financial institutions are doing to justify investment in fossil fuels is what happens when you can’t see the Black Swan — the unexpected event. This happens when you have no imagination or passion. Forecasters are great if they are dealing in straight line extrapolations; curves like sudden consumer desire — which are common in the real world of blood and passion and good causes — are not so welcome.

So we have insurance companies as being ‘early adopters’ of the climate change notion, and investors as being ‘out-of-touch’ supporters of yesterday’s technologies.

Could there be a “perfect storm” that would trigger more general realization among all economic players that we are facing a catastrophic situation? Dan Hardy forecasts: “We predict that a mass real estate buying and selling event by the general public will begin in earnest when the world experiences its first 1/2 trillion dollar climate change catastrophe. This predicted catastrophe will involve more than 100,000 deaths and be highly publicized worldwide.”

A threat this wide can only be met with concerted effort. The aforementioned program called ClimateSafe Villages can give some opening advice and action-lists. I will follow through with additional information on this initiative in a later post.

We could point to a parallel case to make our point. Perhaps this is imperfect, but as a start, consider gunshot injuries, especially coverage in the event of mass shootings.

No insurance company provides liability coverage for illegal acts. Gun manufacturers, however, are legally required to hold insurance, to cover financial responsibility for any types of losses or injuries that a user, buyer, or bystander may experience.

Insurance does not cover mass shootings. Victims are on their own, and the gun-makers have no responsibility.

Much like victims of climate change.

Until insurance companies explicitly linked it to the reason for cancelling policies.

As noted in HEATED, the Washington Post states that “At least five large U.S. property insurers have told regulators that extreme weather patterns caused by climate change have led them to stop writing coverages in some regions, exclude protections from various weather events and raise monthly premiums.”

Savor that phrase: “extreme weather patterns caused by climate change.”

Insurance companies — not jut civilian protestors but an actual economic sector — are saying there is a cause. This is not a random crime. Victims could be treated like the passengers in a plane crash. There is an agency, a responsibility and an insurable outcome.

But at this point we have dithered so long that the climate change remedies will take trillions of dollars and decades of remedial action. This is no longer a problem than can be left to the private sector.

This is a problem of international scope and focus. The sooner we get started, of course, the (relatively) less expensive it will be.

Renewables should seem like an intuitive alternative for insurance companies to fossil fuel revenue. Solar’s rapid growth could lead to as many as 42 million new jobs. That’s backed up by a 38 percent increase in utility-scale solar markets in 2019. But these are still relatively small sectors.

And solar farm facilities are especially prone to climate-related catastrophes, so trading fossil fuels for sunlight is not perhaps a good solution for insurance companies.

Unless they were rewarded — by, say, a government program. The kind of program that led to the sudden rise in EV sales.

Insurers just need to figure out how they can understand, model, and price policies more effectively.

The U.S. insurance industry invests half-a-billion in oil, gas, coal, utilities, and other fossil fuel-related activities, according to a S&P Global report. That’s a slight increase from the $519 billion fossil-fuel investments in 2018.

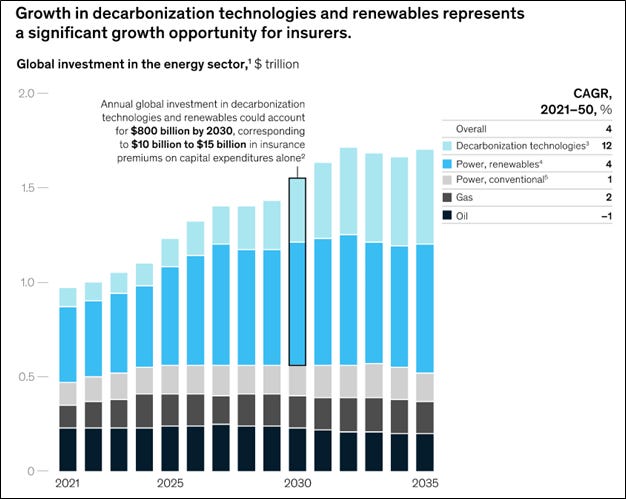

But according to McKinsey their best opportunities for growth come from insuring the renewables industry:

It is not often that a major sector’s interests line up with a deep social cause like climate change. We should propose climate-mitigating measures for common actions by the insurance industry and climate activists working together.

We would be riding a whirlwind right into the face of the fossil fuel industry.

Their days are numbered anyway; some studies indicate that fossil fuels will be obsolete by 2030.

The “Perfect Storm” is on our side: financial awareness, obsolescence of a major pollution technology, and social passion for change.

The alternative is scary: entire communities laid waste because they cannot act on the new vision.

We are one of the major players in a major revolution; when it is done, no one will hand us any medals but our children will breathe freely in a green and open world.

One that is insured for a better future!

Written by Barry Gander

A Canadian from Connecticut: 2 strikes against me! I'm a top writer, looking for the Meaning under the headlines. Follow me on Mastodon @Barry Barry Gander is fully responsible for the contents of his blog post.

Please click here

to see another article on the escalating insurance crisis which preceded the article above called:

Why a Monster Third Wave of Climate Change-Driven Insurance Cancelations and Skyrocketing Rate Increases Are About to Happen Worldwide?

To help do something about the climate change and global warming emergency, click here.

Sign up for our free Global Warming Blog by clicking here. (In your email, you will receive critical news, research, and the warning signs for the next global warming disaster.)

To share this blog post: Go to the Share button to the left below.

Showing 1 reaction

Sign in with